IRS Extends Time to Elect Portability

There is now an opportunity for surviving spouses to take advantage of the higher Estate Tax and GST Tax Exemptions before they sunset in 2026. On Friday, July 8, 2022, the IRS released Revenue Procedure 2022-32, which supersedes Revenue Procedure 2017-34 and extends the period certain estates must make a “portability” election under IRC § 2010(c)(5)(A).

Who Must to File an Estate Tax Return?

The Estate Tax Return is filed for two types of Estates. The Estate Tax Return is required to be filed[1] for Decedents with a gross estate (plus any taxable lifetime gifts) that exceed the Estate and GST Tax Exemption in the year of their death, or in the case of funding certain types of trusts. The Estate Tax Return is not required for Decedents when the gross estate and taxable lifetime gifts is less than the Estate and GST Tax Exemption in their year at death.

Who Should File an Estate Tax Return

The 2010 Tax Act permits a surviving spouse to inherit the unused Deceased Spouse’s Unused Exclusion Amount (DSUE) by filing an Estate Tax Return. Therefore, Estates with a net worth below the estate tax exemption in the year of the Decedent’s death, may file an Estate Tax Return to elect portability and transfer the DSUE to the surviving spouse (“Portability Return”).

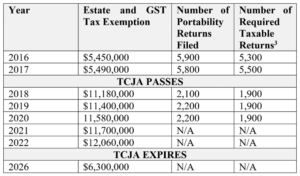

Anyone whose spouse passed away within the last five years with a current net worth greater than $5M should consider filing an Estate Tax Return to Elect Portability. The Tax Cuts and Jobs Act of 2017 (TCJA) doubled the estate, gift, and generation skipping transfer tax exemption and will expire January 1, 2026. Unless Congress passes a new law prior to the expiration of the TCJA, the estate, gift, and generation skipping transfer tax exemption will return to its base of $5M with an annual adjustment linked to the consumer price index. The number of Estate Tax Returns filed was reduced tremendously by the TCJA and will likely increase upon its expiration.

When Does an Estate Tax Return Need to Be Filed?

The Estate Tax Return is due nine months from the Decedent’s date of death. You may file for an automatic 6 month extension by filing IRS Form 4768. For purposes of filing a Portability Return only, the IRS also established an automatic extension two years from the Decedent’s date of death.[2] If the Estate did not file within that two year period, then a Private Letter Ruling from the IRS would be required to submit the late Portability Return as a special case exception.

Now, under Revenue Procedure 2022-32, Estates will have five years from Date of Death to file a Portability Return. This is an opportunity for surviving spouses to file a Portability Return before the Estate Tax and GST Tax Exemption is reduced.

The Decedent must meet the following requirements to file a Portability Return:

(i) Survived by a Spouse

(ii) Passed away after December 31, 2010

(iii) Resident or Citizen of the United States

(iv) Not required to file an Estate Tax Return under IRC Sec. 6018(a)

(v) Decedent’s Estate did not previously file an Estate Tax Return.

An example of the Potential Portability Return Opportunity

I had assisted a surviving spouse with the probate of her husband’s Estate last year (2021). Harry passed away in 2019 with a taxable estate of $4M. Harry’s Will transferred his $4M Estate to Wanda. The Estate and GST Tax Exemption Amount in 2019 was $11,400,000. There was not a requirement to file an Estate Tax Return because Harry’s taxable estate was less than the Exemption Amount.

Wanda missed the six month deadline to file a Portability Return when we completed the probate matter. However, Wanda should consider filing the Portability Return to “inherit” the unused portion of Harry’s Exemption Amount or $7,400,000 ($11,400,000 – $4M).

If the Estate Tax Exemption is reduced in 2026 when Wanda hypothetically passes away with a Taxable Estate of $9M, her children could be forced to pay $1, 080,000 in Estate Tax. However, if Wanda filed an Estate Tax Return to Elect Portability within five years of Harry’s passing, Wanda’s children could “stack” Harold’s DSUE and Wanda’s Exemption Amount together to avoid paying Estate Tax.

|

No Portability Return Filed for Harry’s Estate |

|

|

Wanda’s Potential Taxable Estate in 2026 |

$9M |

|

Exemption Amount |

$6,300,000 |

|

Estate Tax Owed |

$1,080,000 ($2,700,000 x 40%) |

|

Portability Return filed for Harry’s Estate |

|

|

Wanda’s Potential Taxable Estate in 2026 |

$9M |

|

Exemption Amount + DSUE |

$6,300,000 +$7,400,000 |

|

Estate Tax Owed |

$0 |

These materials are made available by Stibbs & Co., P.C. for informational purposes only, do not constitute legal or tax advice, and are not a substitute for legal advice from qualified counsel. The laws of other states and nations may be entirely different from what is described. Your use of these materials does not create an attorney-client relationship between you and Stibbs & Co., P.C. The facts and results of each case will vary, and no particular result can be guaranteed. The facts and results of each case will vary, and no particular result can be guaranteed.

[1] IRC § 6018(a)

[2] Revenue Procedure 2017-34

[3] See Tax Policy Center – How many people pay the estate tax? | Tax Policy Center