Corporate Transparency Act and Trusts

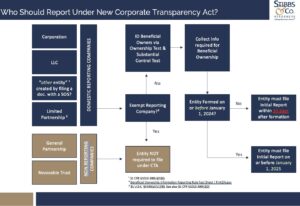

The Corporate Transparency Act (CTA) became effective January 1, 2024 and requires a “Reporting Company” to disclose the “Beneficial Owners” to the US Treasury Department’s Financial Crimes Enforcement Network (FinCEN). That means every LLC, Corporation, and Partnership must report their Beneficial Owners to FinCEN. If the entity was formed prior to January 1, 2024, then the Beneficial Owners must be reported by January 1, 2025. If the entity was formed this year, the Beneficial Owners must be reported within 90 days of formation. Failure to timely report Beneficial Owners to FinCEN is subject to a fine of $500 per day not to exceed $10,000 per violation.

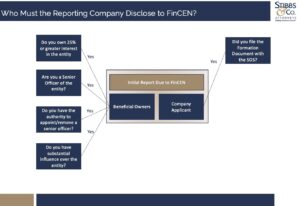

While most trusts will not qualify as a Reporting Company, all trusts holding an interest in an entity will qualify as a Beneficial Owner of a Reporting Company. When a trust is a beneficial owner, the trustee holding the authority to control or dispose of trust assets should provide the following to the Reporting Company:

- Full Legal Name

- Date of Birth

- Address

- ID Number: Driver’s License or Passport with image supporting the unique ID Number

If the trustee prefers to not provide their personal information to the Reporting Company, the ownership can be reported using the contact information for the Beneficiary or the Settlor as follows:

- Irrevocable Trusts:

- A beneficiary (or their Guardian) who is the sole recipient of income and principal of a trust.

- A beneficiary (or their Guardian) who has the right to demand distributions or withdraw substantially all trust assets per IRC § 675(4).

- A Settlor of an irrevocable trust that is considered defective for income tax purposes by holding the power to substitute assets per IRC § 675(4)(c).

- Revocable Trusts:

- The Trust’s Settlor if the Settlor retains the right to revoke the trust or withdraw the assets of the trust.

Stibbs and Co. is a law firm dedicated to helping small businesses succeed. If you need assistance with the new reporting requirements under the Corporate Transparency Act, an attorney in our office would be happy to assist you.

This information is made available by Stibbs & Co., P.C. for informational purposes only, does not constitute legal advice, and is not a substitute for legal advice from qualified counsel. The laws of other states and nations may be entirely different from what is described. Your use of this information does not create an attorney-client relationship between you and Stibbs & Co., P.C. This material may be considered attorney advertising in some jurisdictions. The facts and results of each case will vary, and no particular result can be guaranteed.