Who is my landlord? (Residential Tenancies)

If you are a property manager, you have probably been sued by a tenant regarding an amount that was withheld or deducted from the tenant’s security deposit. The Texas legislature made security deposit lawsuits more beneficial to tenants when they included the following language in Texas Property Code section 92.109(a):

“A landlord who in bad faith retains a security deposit in violation of this subchapter is liable for an amount equal to the sum of $100, three times the portion of the deposit wrongfully withheld, and the tenant’s reasonable attorney’s fees in a suit to recover the deposit.”

Tex. Prop. Code § 92.109(a).

Depending on the amount of money withheld, a security deposit lawsuit can be quite lucrative for the tenant (assuming they can show that the amount withheld was wrongful and that the landlord withheld it in bad faith). For example, if a tenant paid a security deposit of $2,000.00, and all of it is wrongfully withheld in bad faith, the tenant could obtain a judgment against their landlord for $6,100.00 plus attorney’s fees.

However, a common frustration for property managers is that while they are the ones most often sued, they are usually not the correct defendant.

So, who is the correct defendant? The answer is the landlord!

Under the Texas Property Code, the liability outlined in section 92.109(a) specifically provides that “A landlord … is liable ….”

In fact, liability under Texas Property Code Chapter 92, in relation to a security deposit and the accounting thereof, is limited to “landlords.” Texas Property Code sections 92.103, 92.107, and 92.109 all use the term “landlord;” specifically stating that the “landlord” is responsible, obligated, and/or liable. On the other hand, Chapter 92 of the Texas Property Code does not impose any automatic liability on a property manager.

To be sure, Texas Property Code section 92.001(2) defines a “landlord” as follows:

“‘Landlord’ means the owner, lessor, or sublessor of a dwelling, but does not include a manager or agent of the landlord unless the manager or agent purports to be the owner, lessor, or sublessor in an oral or written lease.”

Tex. Prop. Code § 92.001(2).

Based on the statutory definition found in 92.001(2), the “landlord” that is liable to the tenant under 92.109(a) is the property owner and not the property manager. That is, unless the property manager or agent purports to be the owner in a written lease.

How does an agent or property manager purport to be the owner in a written lease?

There are many ways that a property manager can unintentionally present themselves as the property owner. However, the most common way that I have seen is by filling out the lease agreement incorrectly.

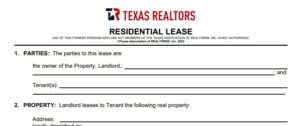

As you can see from the Texas Association of Realtor’s “Residential Lease” form, the parties to the lease agreement are clearly the “owner of the Property, Landlord” and the “Tenant(s).”

Texas Association of Realtor’s “Residential Lease” form (TXR-2001) 07-08-22.

Therefore, if you are a property manager and you are using this form for your lease agreements, you should be writing the property owner’s name on the first line of the lease. I have seen many agents and/or property managers put their own name on this line when they are not the owner of the property. In instances such as this, the agent or property manager has arguably purported to be the owner of the property in a written lease (see Texas Property Code 92.001(2)), and in such an instance, the agent or property manager might arguably be the proper defendant in the tenant’s security deposit lawsuit.

Additionally, even if filling out the lease agreement incorrectly isn’t sufficient to hold a property manager liable under 92.109(a), the property manager could still potentially face liability under a breach of contract theory as they are arguably a party to the contract.

So, to answer the original question of “Who is my landlord?” The landlord is the owner of the property that you are leasing; however, in some instances it might be the property manager (even if they don’t own the property).

Why does this matter?

It matters because you want to make sure you are suing the correct defendant. However, more specifically, for tenants, suing the wrong defendant could get your case dismissed or appealed (to County Court at law). In the event of an appeal, the property manager could end up with a judgment against you for the total amount of attorney’s fees they incurred while defending against your lawsuit as the wrong defendant.

For property managers, it is important that you fill out the lease correctly and avoid taking on unnecessary liability by purporting to be the property owner. However, in the event you are sued anyway, you need to make sure that you include a motion to dismiss as part of your defense to these lawsuits.

This information is made available by Stibbs & Co., P.C. for informational purposes only, does not constitute legal advice, and is not a substitute for legal advice from qualified counsel. The laws of other states and nations may be entirely different from what is described. Your use of this information does not create an attorney-client relationship between you and Stibbs & Co., P.C. This material may be considered attorney advertising in some jurisdictions. The facts and results of each case will vary, and no particular result can be guaranteed.